Financial Advisor Who Specialises in Wealth Management: Expertise that Secures Your Future

- Dipasree De

- Sep 13, 2025

- 2 min read

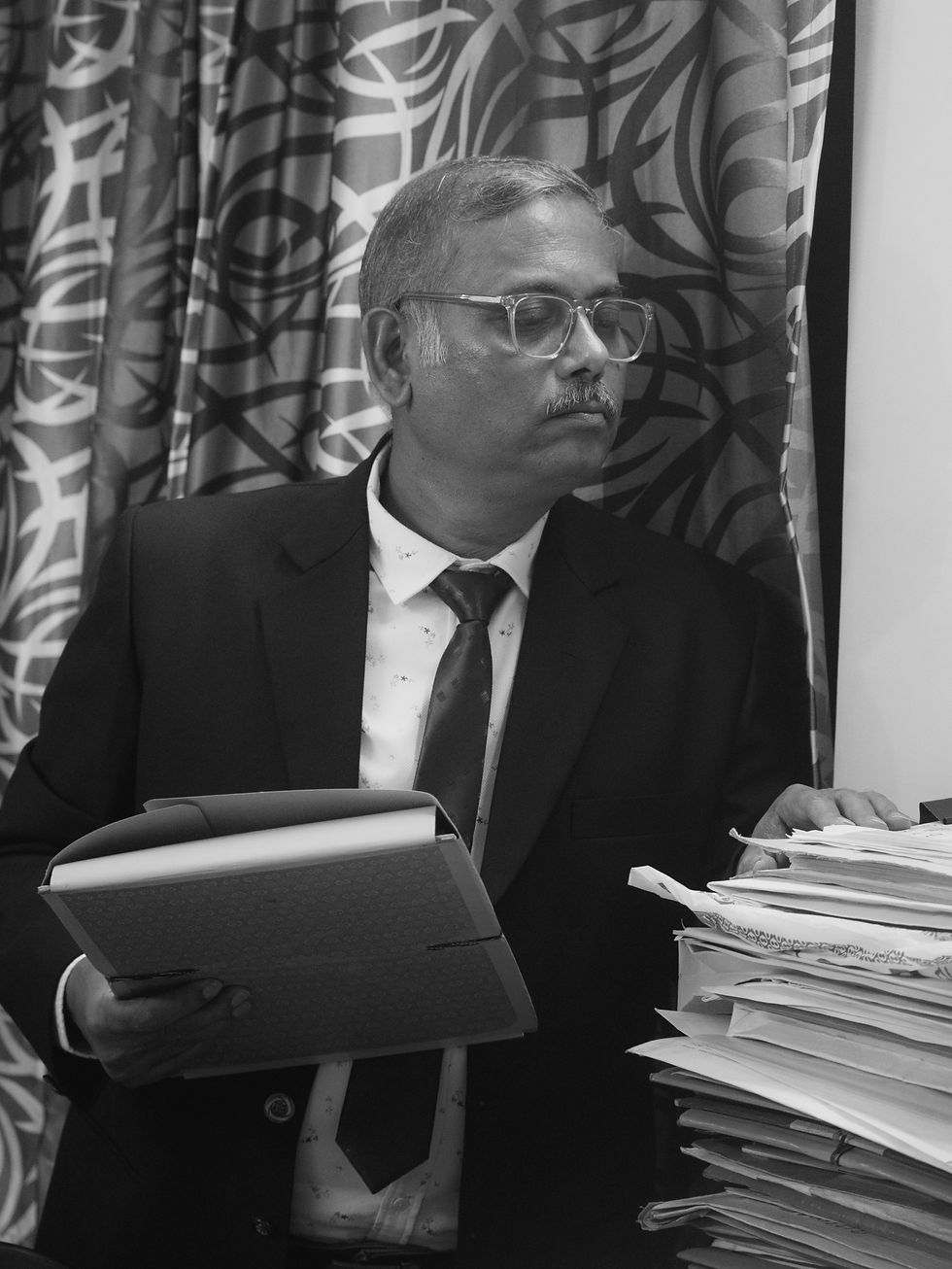

Wealth management does not talk of wealth only but a guaranteeing future so that there is permanent financial stability, conserves your wealth for future generations, and meets long-term financial objectives. We are proud to be specialists in wealth management at PKD Wealth Solutions with our Financial Advisor Mr. Pradip Kumar De having over 38 years of experience in this field.

So, what differentiates wealth management experts and why is it so important to engage the best experts to get the job done?

1. Holistic Financial Planning

You see, investment advice is great, but wealth management is so much more of a complete picture of you. From your income and assets to your liabilities and long-term goals, wealth management experts take into account your entire financial world. At PKD Wealth Solutions, we develop a tailored plan that integrates investment, retirement, and so much more-all with your unique circumstances in mind.

2. Complex Investment Ideas As one of the key wealth management constituents, it includes knowing where and how to invest. By making sophisticated, well-researched, and risk-balanced portfolios, experts like Mr. Pradip Kumar De help grow your wealth. Utilizing deep market understanding and many years of experience, we ensure that our clients diversify their investments by a set of different asset classes in such a way as to maximize returns whilst managing the risks involved.

3. Risk Management

Wealth management involves wealth creation as well as protection of what has been earned. A professional helps you provide the right insurance and risk management strategies to protect your hard-earned assets. Insurance partnerships with leaders like LIC, Care Insurance and Star Health, Niva Bupa Health Insurance enable us to offer powerful insurance solutions that protect your wealth.

5. Retirement and Estate Planning

It also speaks about future planning. Experts suggest you how to ensure you have sufficient resources at retirement so that you spend comfortable days, and it also ensures that your heirs remain secure in their financial future. Whether you need to plan for pensions or invest in Insurance PKD Wealth Solutions structures your wealth to benefit generations to come.

6. Personalized, Ongoing Support

The financial landscape is always changing, and so are your personal circumstances. You would, therefore, want to work with wealth management specialists who would support you through all of this and adjust their strategies accordingly. We stay with you every step of the way at PKD Wealth Solutions and regularly review our strategy to ensure that your financial plan remains inline with your requirements.

Why Choose PKD Wealth Solutions for Wealth Management?

PKD Wealth Solutions is more than financial advice, with the combination of experience and current dynamic and changing markets; it brings comprehensive, customized wealth management that grows and protects your wealth. Our licensed professionals ensure that all aspects of your financial health are covered, so you feel confident in achieving your financial objectives.

Partner with experts in wealth management and position your future in the right hands. Customized strategies and an uncompromised commitment to your success make PKD Wealth Solutions exist to help you ensure a prosperous and sound financial future.

Comments